How standards are unlocking trillions for the energy transition

The imperative transition to a decarbonised economy requires massive capital investments that directly target real emission reductions, as well as substantial resources for adaptation and resilience – preventing dangerous warming while addressing the growing impacts of climate change.

To achieve this, we need to continue transforming energy systems, as well as modernising and digitising infrastructure. It also requires support for sustainable economic and social development in emerging economies, alongside careful stewardship of natural resources.

In the coming years, the pressure to reduce GHG emissions will only intensify. Companies that move early on emissions-reduction pathways will be better positioned, while those that fail to act will face increasing regulatory and financial risks as– extreme weather, economic disruption, health shocks and ecological damage – are set to intensify over the next 25 years.

Capital is abundant, alignment is not

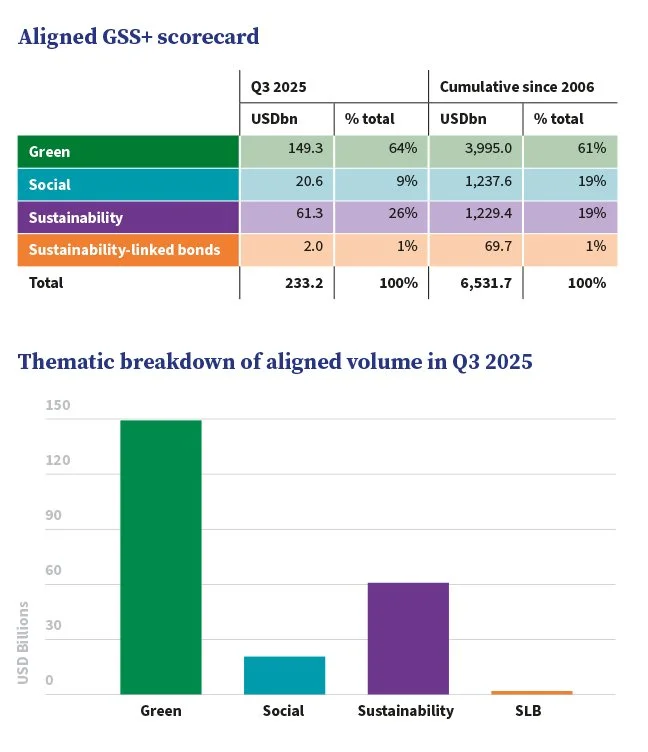

Recent data from Climate Bonds Initiative’s Sustainable Debt Market Summary H1 2025 illustrate how quickly the market is expanding. Sustainable finance is no longer a niche or experimental space; it has become a core pillar of global capital markets.

McKinsey Global Institute estimates that the world must invest around USD 9.2 trillion per year to meet climate goals and prevent unmanageable climate impacts – roughly USD 92 trillion over the next decade alone. And yet, capital availability is not the problem. Global investment pools have expanded intensely over the last 50 years, with the total value of global financial wealth increasing from tens of trillions to over USD305 trillion by 2024.

By mid-2025, cumulative aligned issuance across green, social, sustainability and sustainability-linked bonds (GSS+) reached USD 6.2 trillion. In the first half of the year alone, aligned GSS+ issuance reached USD 555.8 billion – a 17% increase from the average semi-annual volume recorded since 2021 (USD474.9bn).

This growth reflects widespread participation from sovereigns, corporates, development banks and local governments financing renewable energy, industrial decarbonisation processes, expanded grid capacity, low-carbon transportation and building solutions, water systems, and adaptation and resilience measures. It is mobilising capital toward high-impact climate projects, supporting the deployment of emerging low-carbon technologies such as hydrogen and energy storage, and enhancing the resilience and sustainability of critical infrastructure.

When climate risk becomes financial risk

Over the past decade, the rise of the sustainable bond market has shown what is possible when clear frameworks exist. Green, social, sustainability and sustainability-linked bonds (the GSS+ family) have become mainstream investment instruments, consistently attracting strong oversubscriptions. Alongside them, an equally large GSS+ loan market has taken shape, although it is less visible due to limited public reporting.

Investor demand for these instruments is growing for one simple reason: climate risk is now financial risk. The investment landscape is being transformed by both negative and positive climate impacts. Assets exposed to climate policy shifts or physical climate damage are at higher risk of default, while clean energy, electric mobility and resilient infrastructure are becoming increasingly valuable.

Against this backdrop, institutional investors – ranging from pension funds to insurers – are developing transition finance strategies. Examples include Nippon Life’s Transition Finance Framework, Prudential Asia’s Climate Transition Investment Framework, and La Caisse’s 2025–2030 climate strategy.

What the green bond market taught us about trust

The evolution of the green bond market offers the clearest example of the transformative power of standardisation. A decade ago, early issuance was fragmented and definitions varied widely across countries. The introduction of rigorous, science-based criteria – most notably through the Climate Bonds Standard – helped harmonise expectations and build investor confidence.

As consistency increased, so did participation. The market grew globally, issuers diversified, and large-scale capital began flowing into renewable energy, low-carbon transport systems, green buildings and water solutions. Policy frameworks also strengthened, with many countries adopting taxonomies and national guidelines inspired by international standards. What began as a small, specialised niche has evolved into a multi-trillion-dollar market precisely because standardisation built trust.

Standards as the bridge between ambition and capital

As sustainable finance continues to expand, standards are becoming part of the market’s essential infrastructure, comparable to credit ratings or financial reporting. They help investors answer the questions that matter: Is this investment genuinely aligned with the climate transition? Is it credible? Can it be measured and verified? And most importantly, does it support a pathway consistent with limiting warming to 1.5°C?

Sector-level frameworks are playing a similar role. In the context of hydropower, the Hydropower Sustainability Standard offers a consistent, internationally recognised benchmark that supports due diligence and strengthens investor confidence.

In this sense, standards serve as the bridge between climate ambition and financial execution. They translate complex climate science into clear, actionable investment definitions. They offer guardrails that protect market integrity and ensure that sustainable finance delivers real impact. Ultimately, they unlock market opportunities by giving investors the confidence to scale their commitments – and to do so at the speed and magnitude required by the global transition.

As the sustainable finance market enters its next phase of growth, the importance of robust standards cannot be overstated. They are not just technical tools; they are the enabling infrastructure that will determine whether the trillions available today become the trillions invested tomorrow in building a climate-safe, resilient future.

You can find out more about the Climate Bonds Initiative at climatebonds.net.